Introducción a la Cátedra de Gestión de Riesgos

-

https://www.youtube.com/watch?v=guA8WB0CzXY

-

Misión

Crear un ámbito de mejora continua en la gestión de riesgos que esté a disposición de la comunidad, para profundizar sus conocimientos.

-

Visión

Ser un centro de referencia en cuanto a prácticas de innovación y nivel de excelencia académica en gestión de riesgos.

-

Sobre nosotros

La Cátedra de Gestión de Riesgos - CPA Ferrere forma parte del plan académico de la Facultad de Administración y Ciencias Sociales de la Universidad ORT Uruguay.

El Programa en Gestión de Riesgos, diseñado en conjunto por la Escuela de Postgrados en Negocios y la Cátedra de Riesgos - CPA Ferrere, busca ofrecer un conjunto de herramientas que permitan conocer y aplicar metodologías para gestionar los riesgos más relevantes de las organizaciones.

Adicionalmente, la Cátedra promueve eventos dictados por profesionales, docentes y referentes en diversos temas relacionados con la gestión de riesgos.

Está compuesta por un grupo de docentes de primer nivel, con formación y experiencia en la materia, que están a disposición de los estudiantes para ayudarlos alcanzar sus metas profesionales y académicas.

-

https://www.youtube.com/watch?v=OKs7Wf7gvqUPrograma en Gestión de Riesgos

El Programa en Gestión de Riesgos ha sido diseñado en conjunto por la Escuela de Postgrados de la Facultad de Administración y Ciencias Sociales de la Universidad ORT Uruguay y la Cátedra de Riesgos CPA Ferrere, con el objetivo de brindar los principales conceptos y las herramientas necesarias para la adecuada gestión de los riesgos de las organizaciones.

Novedades de la cátedra

-

Primera generación de graduados del Programa en Gestión de Riesgos

-

"Las empresas van incorporando la gestión de riesgos"

-

Gestión de riesgos del talento

-

Aprendizajes, experiencias y desafíos sobre ratio de cobertura de liquidez

-

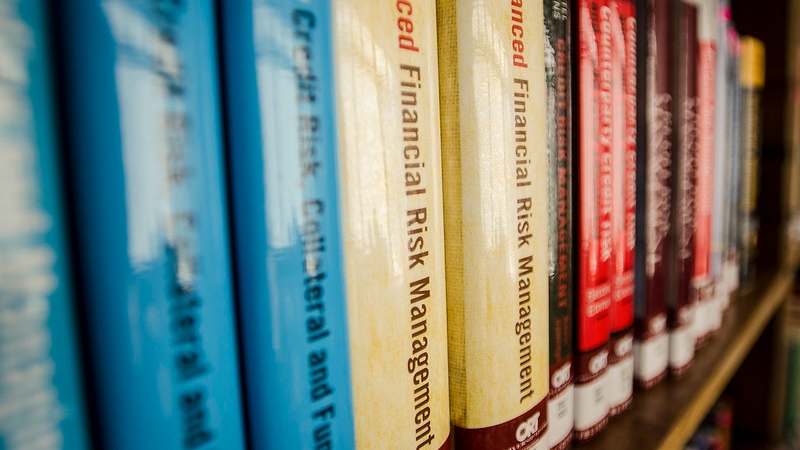

Biblioteca inaugura colección de gestión de riesgos

-

Lanzamiento de la Cátedra de Gestión de Riesgos: “Es tener un mecanismo para tomar buenas decisiones”